The Next Phase of Payments In The US

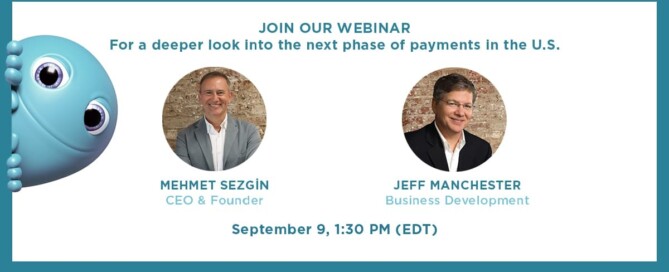

Highlights of myGini Webinar September 9, 2020 Payments after COVID in the US What Will Happen, How will you be impacted? Mehmet Sezgin Jeff Manchester Founder and CEO Business Development The status of contactless/mobile and EMV payments in the US Arguably the worst EMV migration in the world; lack